How to Verify Account on Bybit

Account verification on Bybit enhances security, unlocks higher withdrawal limits, and provides access to additional trading features. Bybit follows a Know Your Customer (KYC) process to ensure compliance with global regulations and protect user accounts.

This guide will walk you through the steps to verify your Bybit account quickly and efficiently.

What is KYC

KYC means “know your customer.” KYC guidelines for financial services require that professionals make an effort to verify the identity, suitability and risks involved, in order to minimize the risk to the respective account.

How to submit a Request for an Individual Lv.1 on Bybit

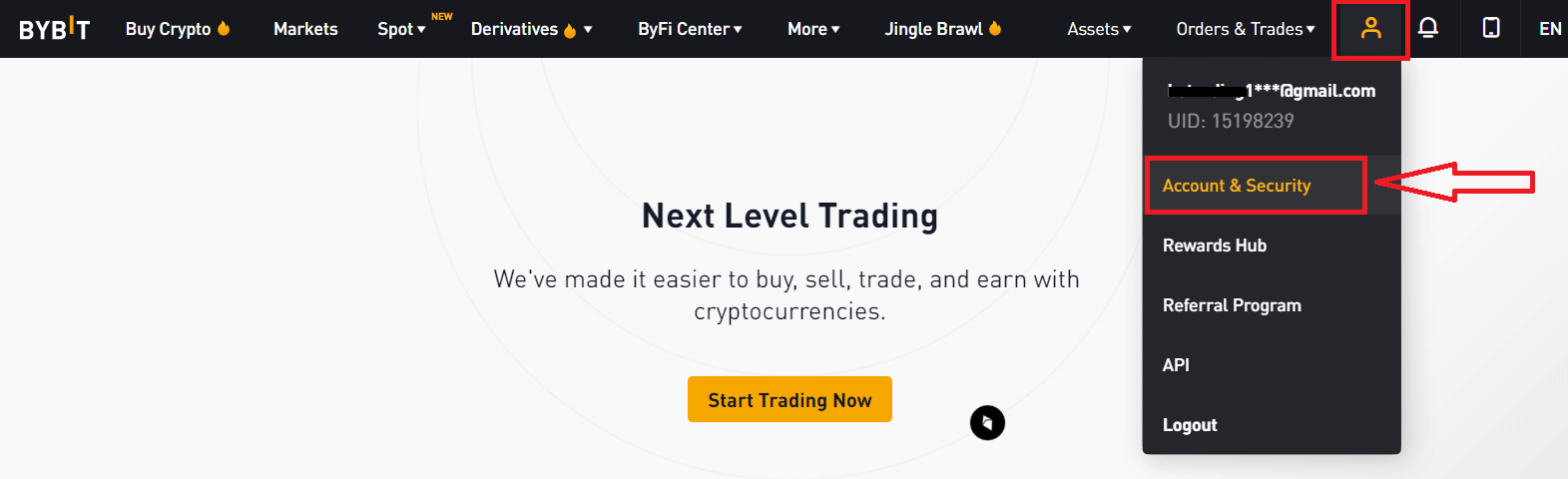

You may proceed with the following steps:1. Click “Account Security” in the upper right-hand corner of the page.

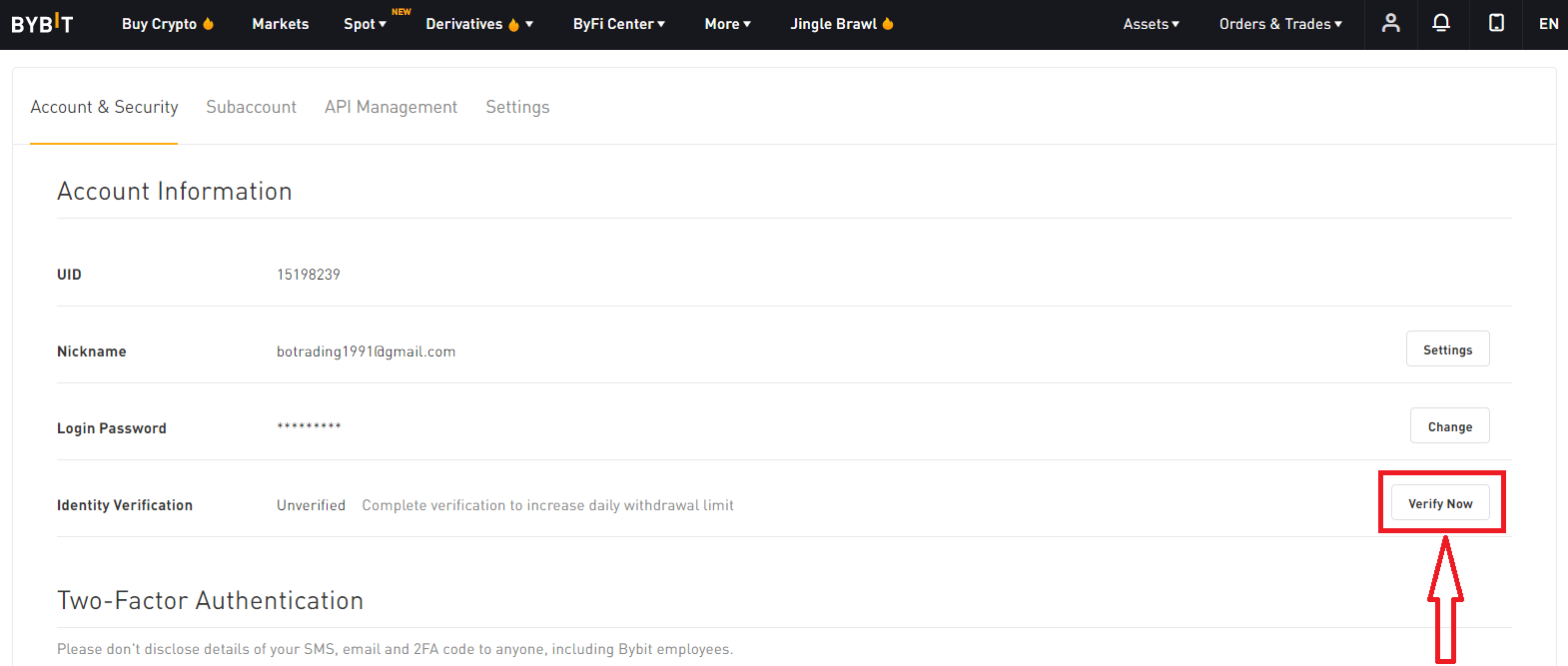

2. Click "Verify Now" in the "Identity Verification" column under "Account Security".

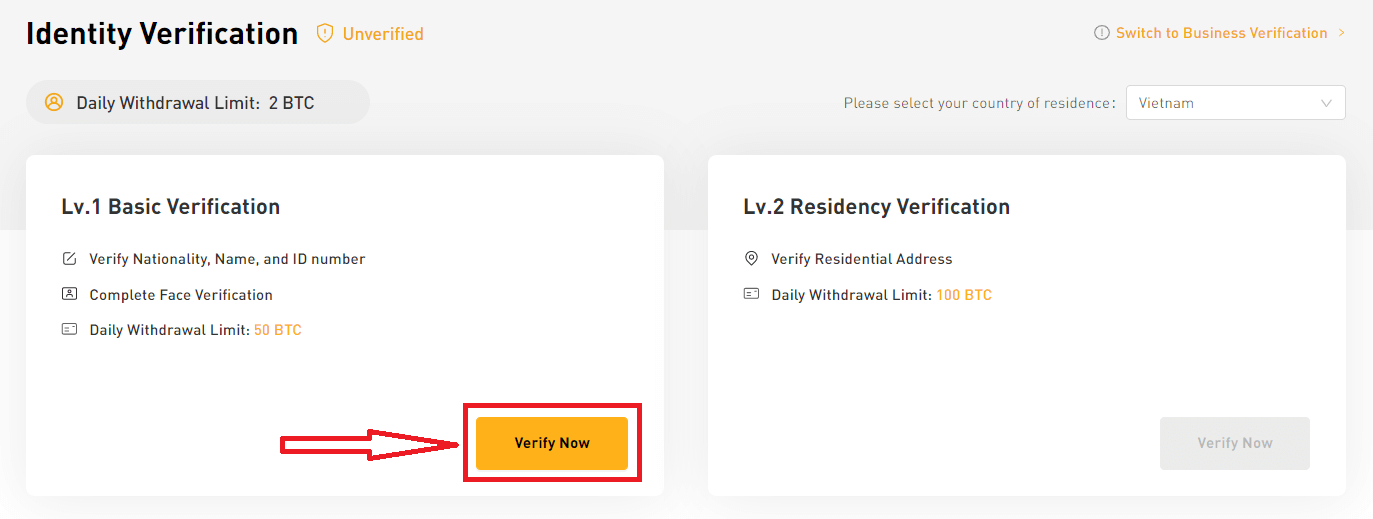

3. Click ”Verify Now” under Lv.1 Basic Verification.

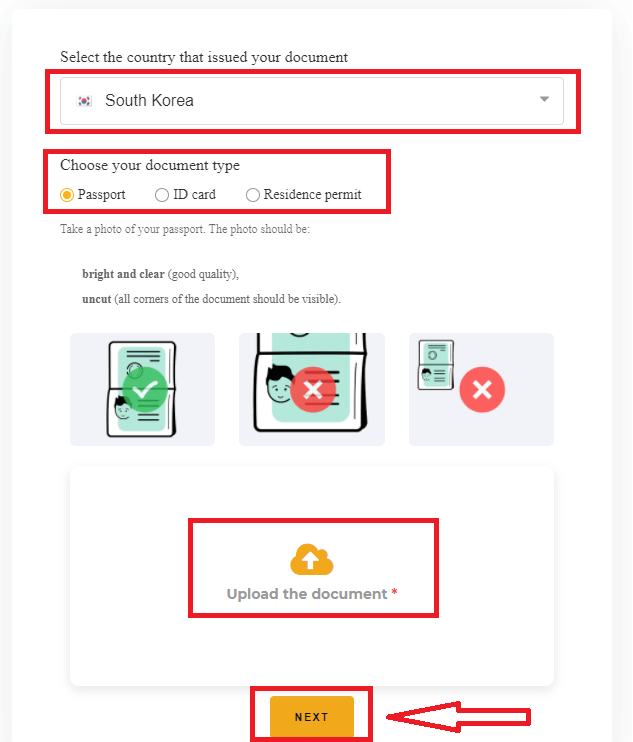

4. Information required:

- Document issued by country of origin (passport/ID)

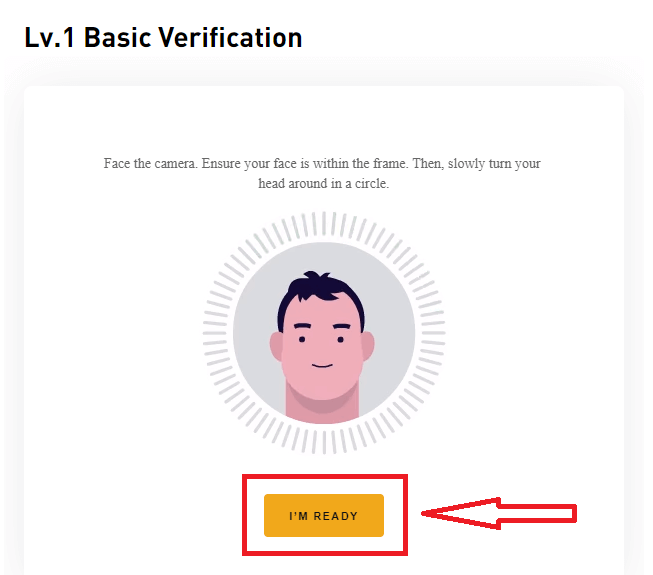

- Facial recognition screening

Note:

- Please make sure the document photo clearly shows the full name and date of birth.

- If you are unable to upload photos successfully, please make sure that your ID photo and other information are clear, and that your ID hasnt been modified in any way.

- Any type of file format can be uploaded.

How to submit a Request for an Individual Lv.2 on Bybit

After verification for KYC 1 has been approved, you may proceed with the following steps:

1. Click “Account Security” in the upper right-hand corner of the page

2. Click "Verify Now" in the "Identity Verification" column under "Account Information"

3. Click ”Verify Now” under Lv.2 Residency Verification

4. Document required:

-

Proof of residential address

Note:

The proof of address documents accepted by Bybit include:

-

Utility bill

-

Bank statement

-

Residential proof issued by the government

By bit does not accept the following types of documents as proof of address:

-

ID Card/driver’s license/passport issued by the government

-

Mobile phone statement

-

Insurance document

-

Bank transaction slip

-

Bank or company referral letter

-

Handwritten invoice/receipt

Once the documents are verified by Bybit, you will receive an email of approval, and can then withdraw up to 100 BTC a day.

How to submit a Request for Business Lv.1 on Bybit

Please send an email to [email protected]. Be sure to include scanned copies of the following documents:

- Certificate of incorporation

- Articles, constitution, or memorandum of association

- Register of members and register of directors

- Passport/ID and proof of residency of the Ultimate Beneficial Owner (UBO) owning 25% or more interest in the company (passport/ID, and proof of address within 3 months)

- Information of one director (passport/ID, and proof of address within 3 months), if different from the UBO

- Information of the account operator/trader (passport/ID, and proof of address within 3 months), if different from the UBO

Once the documents are verified by Bybit, you will receive an email of approval, and can then withdraw up to 100 BTC a day.

Frequently Asked Questions (FAQ)

Why is KYC required?

KYC is necessary to improve security compliance for all traders.

Do I need to register for KYC?

If you want to withdraw more than 2 BTC a day, you’ll need to complete your KYC verification.

Please refer to the following withdrawal limits for each KYC level:

| KYC Level | Lv. 0 (No verification required) |

Lv. 1 | Lv. 2 |

| Daily Withdrawal Limit | 2 BTC | 50 BTC | 100 BTC |

**All token withdrawal limits shall follow BTC index price equivalent value**

Note:

You may receive a KYC verification request from Bybit.

How will my personal information be used?

The information you submit is used to verify your identity. We will keep your personal information private.

How long does the KYC verification process take?

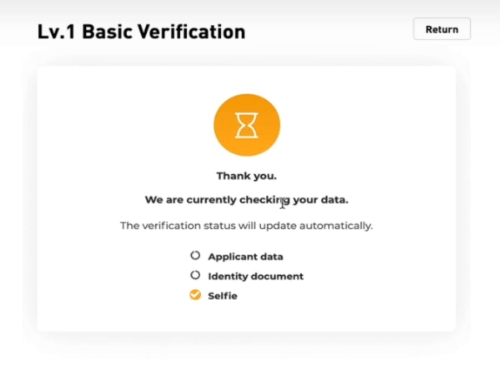

The KYC verification process takes approximately 15 minutes.Note:

Due to the complexity of information verification, KYC verification may take up to 48 hours.